Irs Form 1041 For 2025

Irs Form 1041 For 2025. Form 1041 example return 2025: Income tax return for estates and trusts.

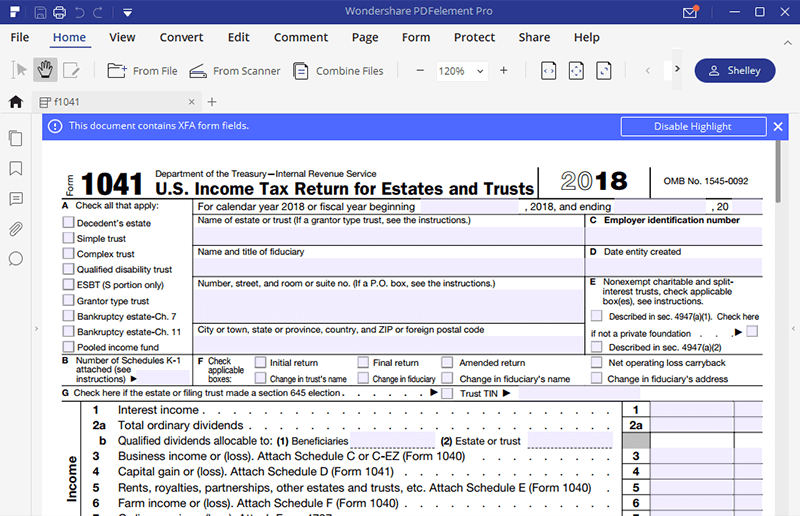

What it is, how to fill it out, how to file it. Form 1041, income tax return for estates and trusts, explained.

Trusts, which are arrangements where a trustee manages money on behalf of a beneficiary, are subject to the same irs filing requirements.

1041 estimated tax form Fill out & sign online DocHub, You always owed federal income tax on interest from savings accounts. The irs released guidance on feb.

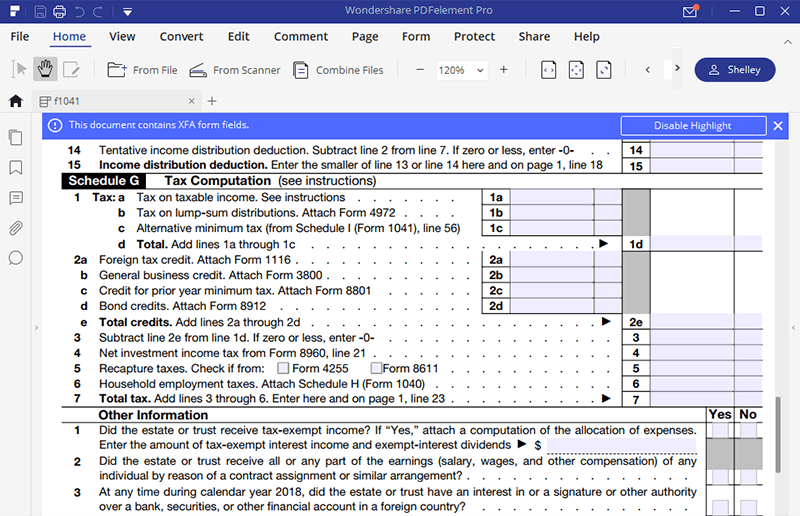

Irs Form 1041 For 2025 Printable Forms Free Online, On form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees, fiduciary fees and itemized deductions. Electronically file form 1098, mortgage interest statement, and form 1099, miscellaneous information.

How To Fill Out 1041 K1 Leah Beachum's Template, Form 1041 serves as the tax return for estates and trusts, akin to the form 1040 used by. Income tax return for estates and trusts, documents the income an estate earns after the estate owner passes away.

Form 1041es Estimated Tax For Estates And Trusts, For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. Form 1041 example return 2025:

Guide for How to Fill in IRS Form 1041, The irs is asking everyone about crypto transactions. These forms are essential in identifying the taxable income of the estate or trust and determining the amount of tax owed.

Guide for How to Fill in IRS Form 1041, Tax forms can be overwhelming, especially when dealing with estates and trusts. A variation of this seemingly innocuous question appears at the top of forms 1040, individual income tax.

2025 1041 Editable Pdf Editable Online Blank in PDF, Form 1041 serves as the tax return for estates and trusts, akin to the form 1040 used by. Form 1041 example return 2025:

:max_bytes(150000):strip_icc()/Form1041Year2021-91aed92e44524bc99dbb7c21c1913264.png)

What Is IRS Form 1041?, Trusts, which are arrangements where a trustee manages money on behalf of a beneficiary, are subject to the same irs filing requirements. Irs form 1041 is an income tax return filed by a decedent's estate or living trust after their death.

Irs Fillable K 1 Form 1041 Printable Forms Free Online, For estate planning and taxation, irs form 1041, u.s. The estate's or trust's alternative minimum taxable income, the income distribution.

Form 1041 Schedule I Alternative Minimum Tax Estates, Form 1041, income tax return for estates and trusts, explained. Income tax return for estates and trusts, documents the income an estate earns after the estate owner passes away.

Travel Hiking WordPress Theme By WP Elemento